Health Insurance

Medical Insurance is provided by Univera Healthcare. Enrollment into medical coverage through Unviera Healthcare will automatically enroll you into prescription drug coverage through Pharmacy Benefit Dimensions and a vision discount plan through Davis Vision at no additional cost. You will receive three (3) cards in the mail for these benefits. Please note they will be mailed separately.

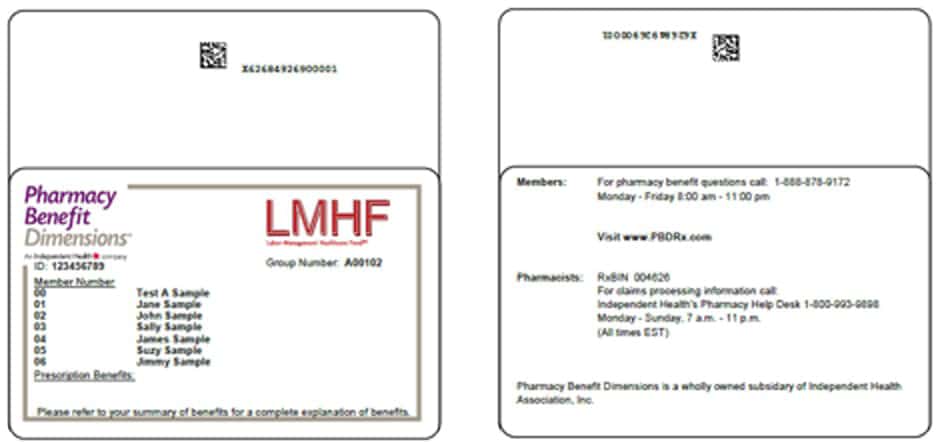

Rx Insurance Card Example

Rx Coverage through Pharmacy Benefit Dimensions (PBD)

Learn more about your Rx coverage, review the drug formulary, find a Pharmacy, set-up mail order for your prescriptions, find information on Specialty Rx, and download forms for prior authorization.

Have a question or need assistance with your Rx benefit?

The Pharmacy Benefit Dimensions’ member services department is here to help with questions regarding your plan, benefits, etc. To reach them, call 1-888-878-9172, Monday through Friday between the hours of 8 a.m. to 11 p.m. You can also email servicing@pbdrx.com.

Health Insurance through Univera Healthcare

Learn more about your health insurance plan and additional benefits such as case management, disease management, telemedicine, find a Doctor tool, treatment cost estimator, and more!

Have a question or need assistance with your health insurance benefit?

You can always reach out to the Benefits Team in the HR Department, however, for some situations you may want to contact Univera Healthcare directly.

Univera Healthcare member services department is here to help with questions regarding your plan, benefits, etc.

Toll Free: (855) 392-3558

Monday – Thursday: 8:00 a.m. – 8:00 p.m.

Friday: 9:00 a.m. – 8:00 p.m.

Saturday – Sunday: Closed

Health Insurance Options

- Bronze Plan (POS 8200) – CSEA and AFSCME members only

- Value Plan (POS 204)

- Core Plan (POS 203)

- Enhanced Plan (POS 202)

If you are making a change or adding a dependent to your coverage, please submit your changes through UKG Pro Employee Self Service during the open enrollment period.

Health Reimbursement Account (HRA)

An HRA is an employer funded account provided to eligible employees (depending on their collective bargaining agreement or MC affiliation) enrolled in the BlueCross BlueShield Value plan. HRA funds can be used to reimburse eligible health care expenses such as insurance copay, glasses, etc.

Unused HRA credits will rollover to the following year until an employee separates from employment.

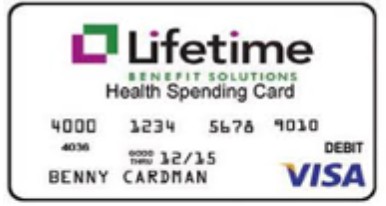

Lifetime Benefit Solutions is the administrator of our HRA and other optional FSA accounts. The same debit card will be utilized for your HRA and FSA. Claims will be paid through your FSA account first and then once depleted your HRA account will be utilized. More information on Lifetime Benefit Solutions can be found on the FSA page.

Dependent Coverage

Children can remain on your medical insurance until the end of the month in which the child turns 26. You will receive COBRA paperwork through our third party administrator, P&A group, in the mail providing you with the option to continue their coverage at the full premium.

2025 Health Insurance Rates

Premiums rates are subject to change annually. The employee responsibility of the premiums is negotiated by your collective bargaining agreement if you’re in a union position or by ECMCC policy if you are Management Confidential (MC). The medical premiums for 2025 did change and the applicable rates are provided on the ECMC Intranet under Human Resources.

Davis Vision Discount Card

Univera Healthcare health insurance members receive free access to the Davis Vision discount program. Davis Vision offers savings on eye care and eye wear. To receive your discount, simply show your Univera Healthcare I.D. card when visiting participating Davis Vision providers.

| Benefits | Member Cost |

|---|---|

| Eye Exam | Covered in full every year |

| Frames | 35% off retail price |

| Lenses Single-vision / bifocal / trifocal / lenticular | $35 / $55 / $65 / $110 |

| Lens options (tint, UV, antireflective, etc.) | Member cost varies based on lens options |

| Contact lens (disposable / conventional / planned replacement) | 15% discount off retail |

Waiver Cash Payment Plan

A Waiver Cash Payment Plan is a biweekly/monthly payment, based on union/MC affiliation, to the employee from ECMC when a benefit eligible employee declines medical insurance. CSEA, AFSCME, and MC employees are not eligible for the waiver if they are insured by an ECMC or Erie County employee. When waiving medical insurance the employee may still enroll in dental insurance.

You can enroll in the Waiver cash payment Plan during Open Enrollment through UKG Pro Employee Self Service.